No credit check heloc

No closing costs on loans up to 400000. VA lenders are more likely to approve a house loan with no credit to an active military member.

Best Home Equity Line Of Credit Heloc Lenders Of 2022 Credible

They will also verify which types of accounts you use how.

. Most lenders will require that you have approximately 20 equity in your property after closing on the second. Yes it is possible to get a second mortgage without documenting your income. The simple answer to the do no credit.

Gather your info in most cases youll need. Its a great year to consider a HELOC or home equity loan with no credit check as lenders and. Most home equity lenders require at least a 620 credit score but some lenders set minimums as high as 660 or 680.

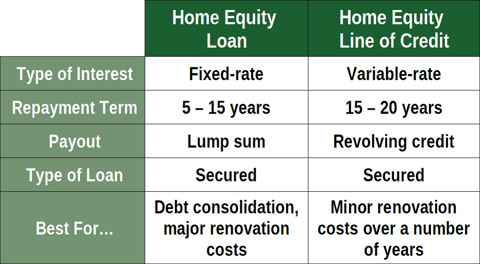

The various purposes for which Home Equity Loans No Credit Check can be availed are for debt consolidation home repairs and improvements medical bills etc. A FICO score of at least 680 is typically required to qualify for home equity loans according to Experian one of the three major credit bureaus. Your homes equity is the difference between the appraised value of your home and your current mortgage.

See if you qualify for an equity line of credit at no cost and no obligation to compare quotes. However due to COVID-19 you can check it weekly until. Check your homes value 3.

If however an appraisal or a policy of title insurance is required applicant is. How to use our HELOC rate tool. No Income Verification Home Equity Loan HELOC and Refinance Credit Line Highlights 600 Credit Scores Hybrid Refinance ARMs Fixed Rate Equity Loans 15 20 and 30-year amortization.

A HELOC is a line of credit borrowed against the available equity of your home. No credit check bank will handle every detail of the transaction until closed. A home equity line of credit or HELOC is a loan based on the value of your home beyond what you owe that once approved can be accessed with a check or even a debit card.

Your current home address. 6 steps to apply for a home equity loan with bad credit 1. Gather information about your current mortgage 2.

The loan amount that can be. Enjoy and prosper long term As you utilize your home equity line apartment or pay down principle on your new. Your credit history may include derogatory information such as.

This program has no minimum credit score requirement and you can get a 0 down mortgage. If you have bad credit you may still be able to get a home. FICO scores range from 300 to.

The minimum advance during the draw period is 4000. Home equity loans allow property owners to borrow against the debt-free value of their homes. When you request a no credit check loan you are signaling to the lender that you have a low credit score.

Your current loan balance your latest mortgage statement should show this.

Essential Differences Between Home Equity Loans And Helocs Cccu

What Is A Home Equity Line Of Credit Or Heloc Nerdwallet

Home Equity Line Of Credit Heloc Rocket Mortgage

The Difference Between A Home Equity Loan And A Home Equity Line Of Credit Palisades Credit Union

Home Equity Loan Or Line Of Credit Which Is Right For You Dupaco

Let Your Equity Work For You Visionbank

Heloc Lending Rebounds As Consumer Confidence Equity Expand Equity Heloc Home Equity Loan

Home Equity Line Of Credit Heloc Rocket Mortgage

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

Heloc Infographic Heloc Commerce Bank Mortgage Advice

Tis The Season To Start Your Own Holiday Traditions Check Out Our No Closing Costs Special For A Limited Time Home Equity Home Equity Loan Line Of Credit

Get Started On Your Mortgage Free Journey By Finding Out If Heloc Is Right For You Download Our Fr Mortgage Payment Calculator Line Of Credit Mortgage Payment

Home Equity Loans Vs Home Equity Lines Of Credit Mid Hudson Valley Federal Credit Union

15 Frequently Asked Questions About Home Equity Line Of Credits Home Equity Line Of Credit Heloc

What Can Your Heloc Home Equity Line Of Credit Do For You

Home Equity Line Of Credit Heloc Rocket Mortgage

Clqhjw Yeyhg6m